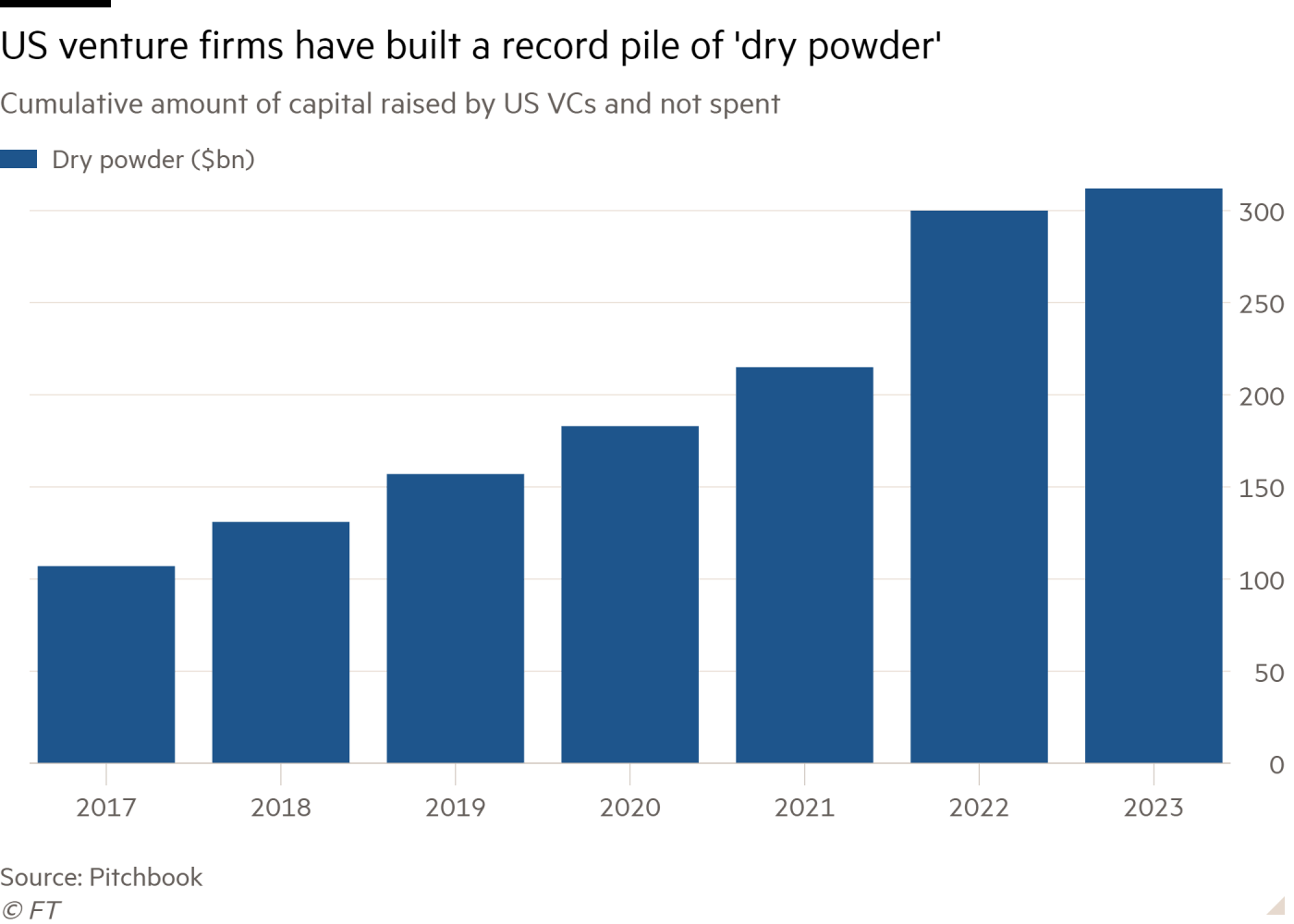

In a recent report by the Financial Times, a fascinating shift in the venture capital landscape has been highlighted, particularly in Silicon Valley. Amidst a funding crunch, U.S. venture capitalists are reportedly sitting on a staggering $311 billion in unspent cash. This phenomenon, often referred to as "dry powder" within the industry, marks a significant change in investment strategies post-pandemic.

The Pandemic-Era Boom and Its Aftermath

During the pandemic boom between 2020 and 2022, American VC groups raised a record $435 billion from investors. Surprisingly, only half of this amount has been deployed, according to data from PitchBook. This cautious approach has been influenced by declining start-up valuations and a strategic shift towards backing more established tech groups or supporting existing portfolios.

Notable Investments and Strategies

One of the most active venture firms, Thrive Capital, led by Josh Kushner, exemplifies this trend. Last year, Thrive invested $1.8 billion in fintech group Stripe, valued at $50 billion, and is also leading a purchase of employee stock at ChatGPT-maker OpenAI, valuing the company at $86 billion.

The Shift in Venture Capitalist Mentality

Ibrahim Ajami, head of ventures at Mubadala Capital, part of Abu Dhabi's sovereign wealth fund, notes that the abundance of dry powder doesn't necessarily mean a flood of VC money into the market. Instead, a significant portion of this capital might be utilized to address the financial challenges arising from the period of ultra-low interest rates, now compounded by rate hikes.

Pressure from Limited Partners (LPs)

Venture funds, during the coronavirus pandemic, raised unprecedented amounts of cash, targeting various sectors like crypto and technology. However, the current scarcity of exits has put VCs under pressure to return capital to their LPs, which include institutional investors, foundations, and pension funds. Last year, US-based VCs distributed only $21 billion back to their LPs, a stark contrast to the total payout in 2021.

Creative Solutions and Future Expectations

To address this, venture capitals like Sequoia Capital are waiving fees on uncommitted capital, and firms like Lightspeed Venture Partners are creating new investment vehicles, such as continuation funds, to unlock cash without traditional exits. The head of investment at a large endowment fund expressed a desire to see venture firms reduce their fund size and return some of the committed money to LPs.

Impact on Start-Ups

This cautious approach by VCs means that young companies without clear profitability or exit strategies may face severe valuation cuts or even failure. Start-up collapses have reportedly doubled over the past year, with previously high-valued companies like Hopin and Convoy among the casualties.

Conclusion

The current state of venture capital, with its massive unspent reserves, signifies a more prudent and strategic approach to investment post-pandemic. While this may lead to challenges for emerging start-ups, it reflects a broader trend of recalibration in the investment world, particularly in the dynamic environment of Silicon Valley.

For more in-depth analysis and detailed insights, refer to the original article by George Hammond and Tabby Kinder in the Financial Times.